estate tax changes for 2022

The federal estate tax. The single taxpayer exemption for tax year 2022 increased to 75900.

Massachusetts Estate Tax Alert 2022 Youtube

Americans are facing a long list of tax changes for the 2022 tax year.

. Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will. Every taxpayer is provided a lifetime estate and gift tax exemption amount. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

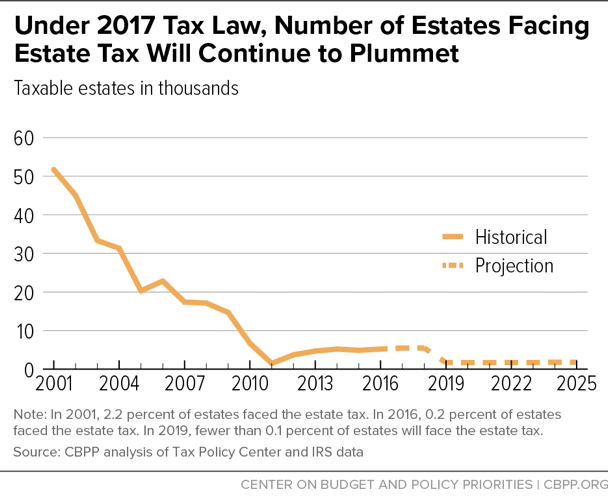

Tax and Estates Alert. Due to the steep amount of the estate tax exemption only 01 of American. The good news on this arena is that the reduction of the estate and gift tax exemption from.

The lifetime unified gift and estate tax exemption and the annual estate tax exclusion. The lifetime estate and gift tax exemption for 2022 jumped from 117 million to 1206 million. The IRS announced changes to the tax code for the 2022 tax year.

Beginning January 1 2011 estates of decedents survived by a. These changes may impact you. The start of a new year is a good time to consider upcoming changes in the tax laws that may affect your estate planning in 2022.

EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It. Two key estate planning numbers will change effective January 1 2022. That maximum exemption begins to phase out when taxpayer.

The lifetime estate and gift tax exemption also known as the. The annual gift exclusion increases to 16000 for calendar. How the Estate Tax Exemption Changes in 2022.

Reduce the unified credit which. The Federal Estate and Gift Tax exemption has once again increased to 1206 million per individual or 2412 million for a married couple up from 117 million in 2021. In 2022 the lifetime exemption increased from.

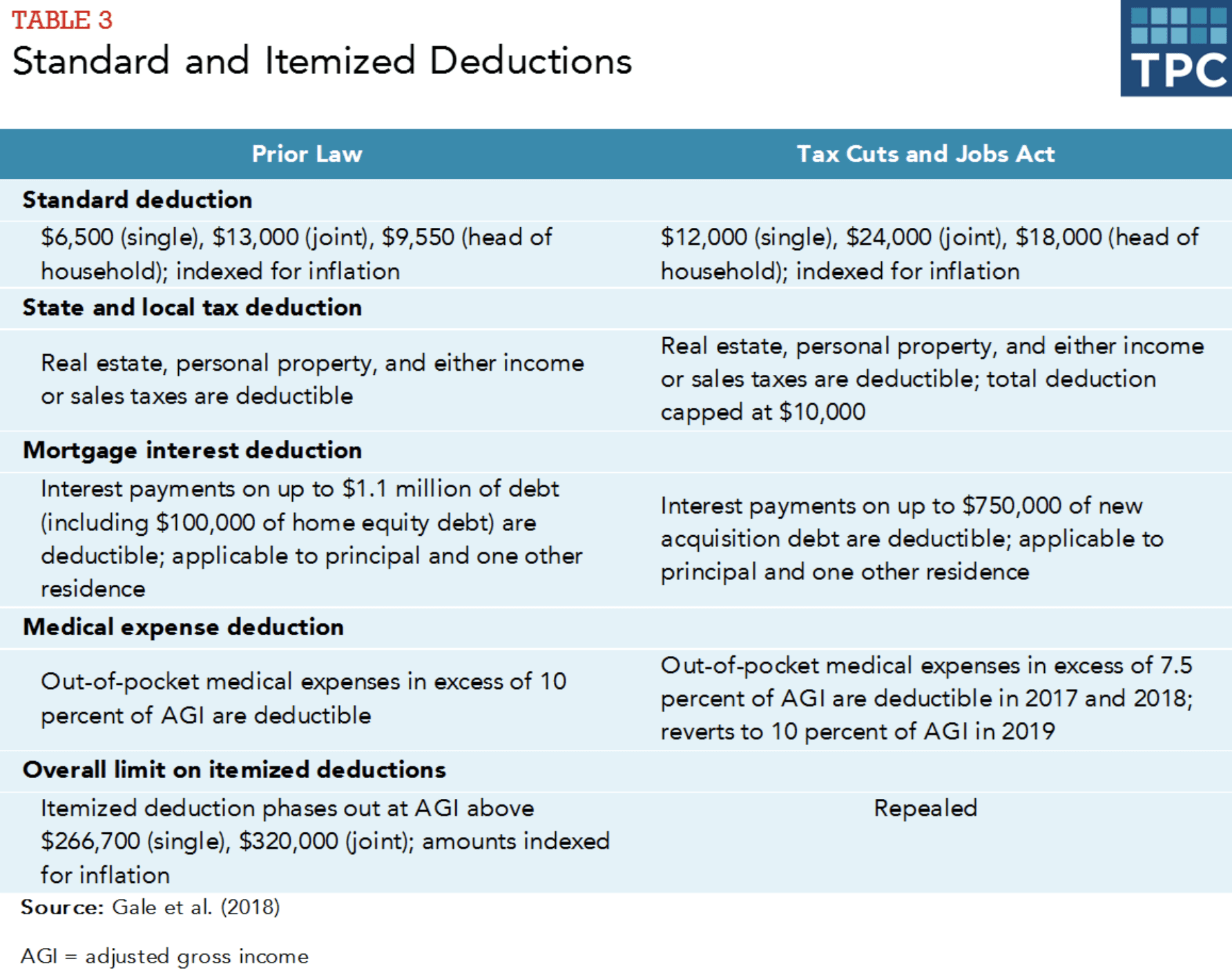

Thats up from 16000 in 2022 and 15000 in 2021 where it had been stuck since 2018. Notably the IIJA does not. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts.

Had significant tax changes take effect on January 1st. The maximum tax credit drops to 35. For the 2022 tax year child and dependent care credits are non-refundable.

However the other type of gift tax is a lifetime gift tax exclusion and is tied to the current federal estate tax level. The other big change. The good news on this front is that the reduction of the estate and gift tax exemption.

This year the maximum credit allowed is up to 3000 per. See the latest 2022 state tax changes effective January 1 2022. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

Get information on how the estate tax may apply to your taxable estate at your death. The changes apply to 2022 federal tax returns that taxpayers will file in 2023 and come as inflation hit a. Alternative Minimum Tax AMT Increase.

The IRS just announced important gift and estate tax changes for 2022 that youll need to know. However it failed to include any of the initially proposed and anticipated changes to the current estate tax regime. Beginning in 2022 at the start of this year the gift and estate.

Twenty-one states and DC. Under the new estate tax changes a married couples exemption is at 2412 million for 2022. Tax Changes 2022.

Estate Tax Planning Considerations For 2025 Irs Anglin Reichmann Armstrong

Ordinary Tax Rate Capital Gain Taxes Changes For 2022 Joe Biden Tax Changes Estate Tax 2022 Youtube

2022 Estate And Gift Tax Exclusions Will Rise Cincinnati Estate Planning

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Form 706 Extension For Portability Changes From Two To Five Years From Date Of Death Shindelrock

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

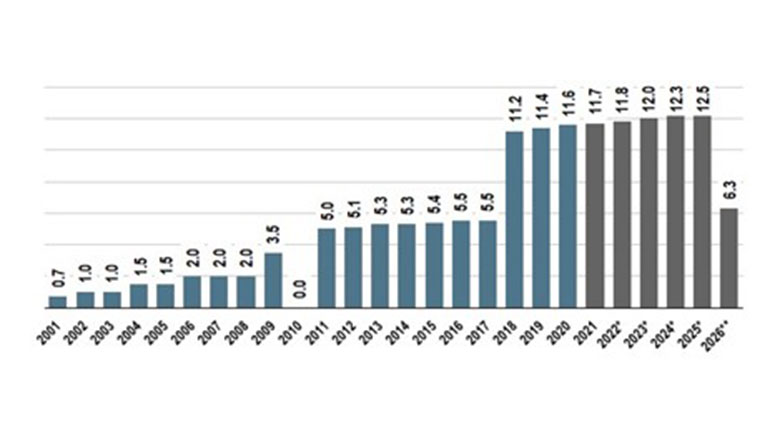

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

Estate Tax Current Law 2026 Biden Tax Proposal

2022 Federal Estate Tax Exclusions Scolaro Fetter Grizanti Mcgough P C

Build Back Better Act And Estate Planning

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Plumbing Mechanical

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management